*** SEE THIS SPECIAL VIDEO REPORT ***

[Click play and turn up your speakers.

Allow 5-10 seconds for video to load.]

Dear Concerned Investor,

Brace yourself.

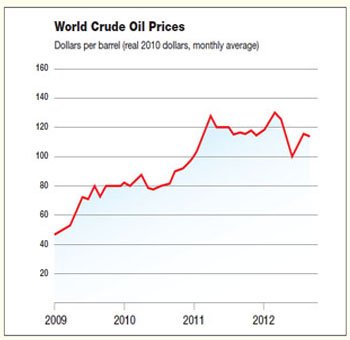

Thanks to increased volatility in the Middle East—including the growing potential for a war between Iran and Israel—gas prices are on the verge of jumping to more than $9 a gallon.

But even as these soaring prices take a big bite out of your budget in the months, they could also turn into an opportunity for you to make 5 times your money with an undervalued junior oil company.

Plus, the company is sitting on so much oil that even if oil prices stay right where they are, you could still double your money

The company: New Western Energy Corp. (NWTR)—a little-known, U.S.-based junior oil and gas company that’s already producing oil in Oklahoma and Texas.

Double—or even quintuple—your money

in the midst of stock market turmoil

Right now, New Western Energy Corp. (NWTR) is sitting on 13.7 million barrels of oil valued at $1.3 billion—and the value of every barrel it owns could increase right along with the price of oil.

A modest $5,000 investment in this still-unknown company could quickly turn into $25,000 or more if and when Middle East tensions boil over into full-fledged conflict.

But even if war in the Middle East is averted, you could still turn $5,000 into $10,000 because the company’s share price doesn’t even begin to reflect the company’s massive holdings of the black gold that the U.S. economy depends on.

And get this: Despite its 13.7 million barrels of oil—and the fact that the company is already producing oil in Oklahoma and Texas—its shares are priced like it’s a debt-ridden, fly-by-night exploration company.

Simply put, this company is a perfect candidate for short-term profits—even while the stock market is falling.

Thanks to the volatile situation in the Middle East, I expect oil prices to soar over the next 2 years. And that could dramatically increase the value of New Western Energy’s oil reserves.

Listen…I’m so impressed by this company, its 13.7 million barrels of recoverable oil reserves and management’s more than 100 years’ worth of experience in petroleum geology and engineering, I strongly believe you could potentially double your money even if oil prices remain flat.

However, if things blow up in the Middle East, you could make 5 times your money or better over the next 12 months.

A unique opportunity with a hugely undervalued company

Right now, New Western Energy is trading for 58 cents a share. But with nearly $1.3 billion worth of recoverable reserves (at today’s oil prices)—this stock could shoot up to $1.30 a share.

And that’s if things remain calm in the Middle East and oil prices don’t budge.

But thanks to geopolitical instability—especially in the Middle East—I believe a $30-per-barrel spike could be around the corner. And that could send the value of New Western’s reserves soaring.

A modest investment in New Western Energy Corp. (NWTR) now could help you soften the blow of rising oil prices. After all, every $5,000 you invest could turn into $25,000 within the next 12 months.

However, even if oil prices stay right where they are, New Western Energy Corp. is sitting on enough oil reserves to potentially double your money.

Take a look…

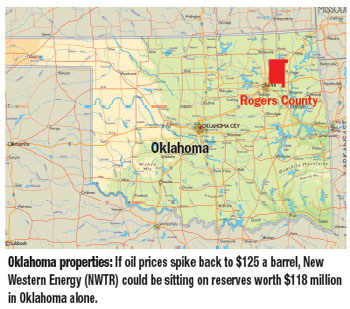

$118 million worth of oil in the sands of Oklahoma

New Western Energy (NWTR) owns property rights in two significant properties in the immensely productive Bartlesville Sand Formation in Oklahoma that hold a total of 20 wells: the Phillips Lease and the Glass Lease. And the Glass Lease is already in production!

The company is sitting on recoverable reserves of 944,915 barrels of oil in Oklahoma alone. And two of the wells on the Glass Lease were put into production back in June 2009, meaning there’s a proven history of production.

At $95 per barrel, that’s $89.7 million worth of oil from these two properties…

But if oil prices spike back up to $100 per barrel…you’re looking at $94.4 million worth of oil…and at $125 per barrel…New Western Energy Corp. is sitting on more than $118 million worth of “Sooner Oil Riches.”

However, Oklahoma is just one part of the equation…

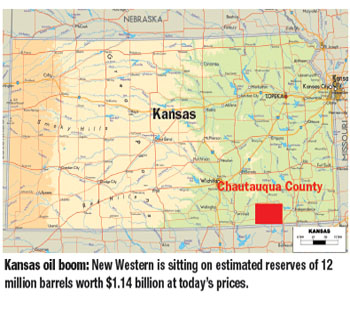

Stake your claim to the $1.1 billion “Kansas Oil Boom” windfall!

Early in 2012, New Western (NWTR) made two key acquisitions that have helped it solidify its outstanding portfolio of assets in Kansas, which is in the midst of a surprising oil boom attracting major oil industry players, including Chesapeake Energy, SandRidge Energy and even Shell Oil.

In March, New Western Energy acquired a 90% working interest in the B&W Ranch Oil and Gas Lease in Chautauqua County, Kansas.

This 1,700-acre property is has the potential to host numerous oil and gas discoveries.

The B&W Ranch Lease is located in the Chautauqua Arch—in the middle of a region known for its historical production. The recoverable reserves are estimated at 9,141,823 barrels of oil worth $868.4 million.

A 2011 report on the property estimates that the lease potential exists for the discovery of 3 to 4 oil formations—as well as 3 to 4 gas formations.

And that’s not all. In May, the company acquired the Smith Lease—a 550-acre property with potential reserves worth more than $280.9 million.

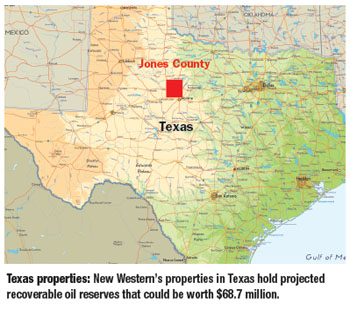

A potential $68.7 million worth of black gold in Texas!

New Western’s (NWTR) Texas holdings begin with the Swenson Lease—a 160-acre property in Jones County, Texas, surrounded by wells with a proven history of oil production.

The initial test well on this property provided spectacular results. And recoverable reserves are now projected at 88,677 barrels of oil—worth $8.4 million at today’s oil prices.

Better yet, the company has additional leases next to the Swenson property—at McLellan and Reves—with a recoverable reserve of 135,164 barrels.

Altogether, New Western’s total recoverable reserves in Jones County are just 223,841 barrels of oil—worth $21.2 million at today’s prices.

But if oil prices spike to $125, New Western Energy (NWTR) could find itself sitting on more than $27.9 million worth of oil in Jones County alone.

This is great news for a little-known exploration and production company that trades for 58 cents. You can see why I think it’s likely the share price could double even before oil prices begin to spike!

Better yet, New Western’s Trice and Moran properties in Shackelford County, Texas, host 36 oil wells and six water injection wells.

Early projections put the recoverable reserves at 500,000 barrels of oil from these two properties.

And the Trice property is already producing oil.

With potentially 723,841 barrels of oil in Texas alone, New Western Energy (NWTR) is—quite possibly—sitting on $68.7 million worth of oil at today’s prices.

And a spike in oil prices to $125—which is just a Middle Eastern conflict away—could send the value of the oil in Texas alone to more than $ $90.4 million.

These Texas properties are just another reason I strongly recommend you add New Western Energy Corp. (NWTR) to your portfolio.

The potential value of the company’s recoverable reserves is strong enough to justify a price that could reach more than $1.30 per share—and that’s before a potential spike in oil prices is factored in.

Anatomy of a bargain:

More than $1.3 billion worth of oil—yet New Western

Energy Corp. (NWTR) is STILL undervalued!

The case for New Western Energy is simple:

- Its Oklahoma properties have recoverable reserves of 944,915 barrels

of oil. - In Kansas, its reserves are conservatively estimated at 12 million barrels.

- And in Texas, the company could be sitting on another 723,841 barrels.

That’s $1.3 billion worth of oil—at today’s prices—that New Western is sitting on right now.

If oil spikes to $125, as I expect, that brings the total up to $1.7 billion.

I don’t know any other way to put it: At 58 cents a share—and sitting on this much oil—New Western Energy is an absolute steal right now.

5 critical advantages New Western Energy has

that could help you make 5 times your money

With its impressive collection of assets, New Western Energy Corp. (NWTR) is poised to provide outstanding potential returns to investors who act quickly while the company’s share price is still low.

But what makes New Western Energy stand apart from the “other” small oil companies you’ve seen over the past few years?

Based on my experience—and my close examination of this company—I see five critical advantages that New Western Energy brings to the table…advantages that work in your favor!

- Critical Advantage #1: New Western Energy isn’t just searching for oil—it’s already producing in Oklahoma and Texas. I can’t stress enough just how important this advantage is—New Western has already progressed to the point of production in multiple locations!

- Critical Advantage #2: The company’s experienced management team has an impressive combined history of more than 100 years in petroleum geology and engineering.

- Critical Advantage #3: New Western is aggressively acquiring great properties—at low entry costs—and then exploiting the upside potential. They’re taking advantage of the success they’ve had to date—and looking to build their property portfolio quickly.

- Critical Advantage #4: New Western Energy’s balance sheet is strong—and their joint venture approach maximizes the upside potential with reduced downside risk with each new well.

- Critical Advantage #5: New Western Energy presents a “heads-you-win…tails-you-win-more” scenario. You see…even if the situation in the Middle East stabilizes…and oil prices remain flat—New Western Energy is still a potential double.

But when you factor in the potential for a sudden, upward spike in oil prices—thanks to conflict in the Middle East—you’ve got the potential for a life-altering investment return on your hands.

I strongly urge you to consider adding New Western Energy (NWTR) to your portfolio today.

When you do, you’ll be taking advantage of what I consider to be one of the best junior oil company opportunities to come along in years…and you’ll set yourself up for potential triple-digit profits within the next 12 months.

If you want to go one step further—and begin building lasting wealth whether the stock market is trading higher or lower—then I encourage you to try my weekly online market letter—Cotton’s Technically Speaking—so you can begin cashing in on double- and triple-digit stock winners on a regular basis.

Click here now to subscribe to Cotton’s Technically Speaking and claim your

Act now—before you miss out on the next 625% winner!

When you subscribe to my Cotton’s Technically Speaking, you’ll receive regular analysis and updates on New Western Energy Corp. (NWTR) plus dozens of additional profit-packed investment recommendations every year.

Over the past few months alone, my readers have seen winning recommendations like…

- 117% gains from CytRx Corp. (CYTR)

- 625% gains from Arena Pharmaceuticals (ARNA)

- 122% gains from Horizon Pharmaceuticals (HZNP)

- 150% gains from Repros Therapeutics (RPRX)

- And 152% gains from Osiris Therapeutics (OSIR)

By the way, I’m also committed to helping my subscribers—by means of my proprietary market indicators and analysis—stay ahead of major market trends.

I helped steer investors to safety before the collapse of 2008…and I also called the bottom of that bear market—helping investors get back into stocks at precisely the right time.

Click here now to subscribe to Cotton’s Technically Speaking and claim your

Stay connected to accurate market forecasts

and winning stock picks every week!

Cotton’s Technically Speaking is a weekly email newsletter—not a monthly service where precious time could pass between a recommendation and an update.

You’ll stay connected with me at all times—via the weekly issues…special email updates and our 24/7 website.

As a subscriber, you’ll receive…

- Weekly issues of Cotton’s Technically Speaking delivered directly to your email inbox: Each issue features my market analysis and commentary PLUS four to six carefully selected new stock picks for you to act on right away!

- Special “Market Alert” email updates: Whenever I see a major market move ahead—either up or down—I’ll send you a special bulletin right away.

- Advance warning on quick sell-offs: Thanks to my proprietary methods for technical analysis, I can see large sell-offs on the horizon—and when I do, I make certain that my subscribers know what’s about to happen before it takes place.

To get started today—and claim your FREE report—click here.

Subscribe to Cotton’s Technically Speaking for 2 years,

and SAVE 35% off the regular price…

PLUS get 2 FREE Special Reports

Subscribe to my Cotton’s Technically Speaking for 2 years (96 issues) for only $325—that’s a 35% savings off the regular $500 price. Plus, I’ll send you the following 2 Special Reports (a $78 value yours FREE!).

FREE Special Report #1: 5 Rules for Superior Stock Trading (a $39 value)—in this report, you’ll discover the very best time to take profits on a winning stock…how to avoid large losses…and the single most important rule to consider each and every time you invest…plus much more!

FREE Special Report #2: How to Thrive in Good Markets AND Bad (a $39 value)—the key to becoming a successful investor is being able to not only make money in bull markets…but also still thrive when the bears take over. This easy-to-understand guide will show you the simple steps you can take—NOW—to ensure wealth-building success in any market!

In all, this is a total of $78 in wealth-building information—yours FREE.

Subscribe for 1 year and save 30%…

PLUS you’ll still get a FREE Special Report

If a 2-year commitment is too much for you right now…I understand.

That’s why I’ve arranged for you to still receive a FREE gift—and a discount of 30% off the regular $250 price—when you sign up for a 1-year subscription. You’ll still receive the Special Report, 5 Rules for Superior Stock Trading—

10-Day Quick Response Bonus Report:

Make 5 Times Your Money

with This Oil and Gas Superstar

In this quick response Bonus Report, Make 5 Times Your Money with This Oil and Gas Superstar, you’ll discover even more of the reasons I believe New Western Energy Corp. (NWTR) is poised to soar in the next 12 months!

This in-depth, yet easy-to-read report—a $20 value—is yours FREE when you subscribe within the next 10 days!

To claim your FREE copy, simply click here.

My Personal Ironclad 100% Money-Back Guarantee

Give my newsletter, Cotton’s Technically Speaking, a try. You must be completely satisfied with the investment recommendations and market analysis you receive. If not, simply cancel anytime within the first 30 days and I’ll refund every penny you paid in full—no questions asked!

And if you aren’t satisfied after the first 30 days have elapsed, you are, of course, entitled to a pro-rated refund for the unused portion of your subscription at any time.

You’re welcome to keep all the issues you’ve received—plus the FREE Special Reports—with my compliments.

Start your subscription today

It’s time for you to get started—with Cotton’s Technically Speaking AND the up-and-coming oil and gas superstar that is poised to soar in the months ahead.

Call 1-727-343-3439 (10:00 a.m. to 9:00 p.m. EST, Monday–Friday)—or to get started right away—and join my exclusive group, click here to claim your FREE gifts and start your subscription today.

Sincerely,

Joseph Cotton

Editor, Cotton’s Technically Speaking

P.S. I’m convinced that New Western Energy Corp. (NWTR) could help you rake in double- or triple-digit profits in the next 12 months even without a spike in oil prices. But given the instability in the Middle East…a spike of $30 or more in oil prices could happen overnight—sending New Western shares soaring much higher! It’s important that you get in today before that big move happens!

P.P.S. Start your subscription to Cotton’s Technically Speaking and get up to 2 FREE Special Reports valued at $78—plus the quick response bonus if you respond in the next 10 days! To order, call 1-727-1-727-343-3439 (10:00 a.m. to 9:00 p.m. EST, Monday–Friday) or click here right now.

New Subscriber Online Savings Certificate

![]() I want to take profitable advantage of your great investment recommendations—like New Western Energy Corp. (NWTR)—on a regular basis. Sign me up for Cotton’s Technically Speaking today so I can profit from your 35 years of experience in the markets—and your amazingly accurate market forecasts. I understand that regardless of the subscription term I choose, I’m protected by your Ironclad 100% Money-Back Guarantee.

I want to take profitable advantage of your great investment recommendations—like New Western Energy Corp. (NWTR)—on a regular basis. Sign me up for Cotton’s Technically Speaking today so I can profit from your 35 years of experience in the markets—and your amazingly accurate market forecasts. I understand that regardless of the subscription term I choose, I’m protected by your Ironclad 100% Money-Back Guarantee.

|

A $78 value, yours FREE |

|

A $39 value, yours FREE

|

|

|

1-727-343-3439

(10:00 a.m. to 9:00 p.m. EST, Monday–Friday)

Your satisfaction is guaranteed

Please note: Your privacy is 100% guaranteed. We never share your name or email address with anyone for any reason.

5 Rules for Superior Stock Trading

5 Rules for Superior Stock Trading